This is the second part of the Finance your Car post.

So should you get a car or should you wait?

- If you have a debt except a house loan of which 60% is paid off, yes you could actually go for a reconditioned car on leasing.

- You have taken care of a Retirement fund.

- If you have 4 to 6 months of emergency expenses kept in place? and,

- If you have a hefty savings account in place, then you could buy a car.

See here I picture myself broke. Half of the salary is paying off the house. Let’s say you commit around Rs 8,000 – 10,000 monthly in your house repayment loan and you would have to commit another Rs 5,000 – 6,000 in car payments monthly.

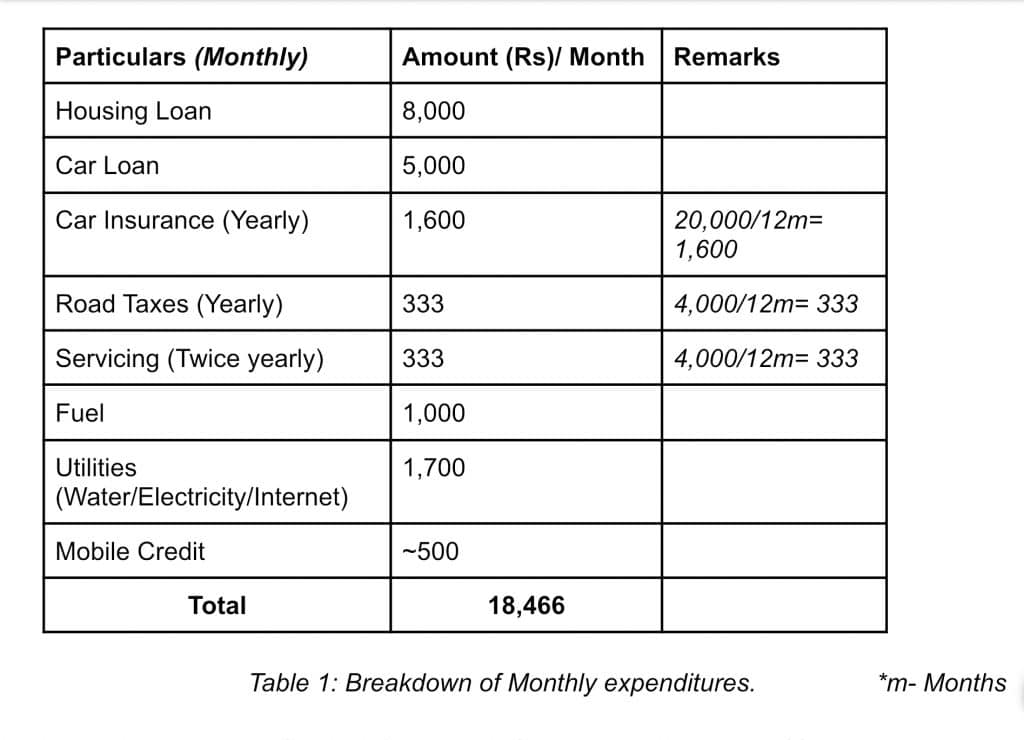

The table below demonstrates expenses related per month:

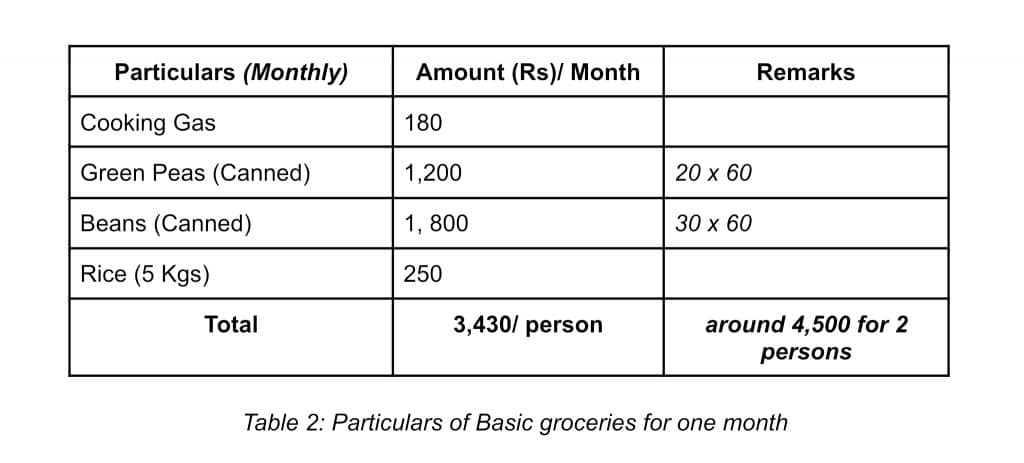

Your car would need fuel right? You are left with around Rs 7,000 (if you make a salary of Rs 25,000 monthly), excluding your mobile debts, laptop debts or any other things that you might have bought on loan or EMI. You also have to pay for your basic utilities. So technically if you survive on rice, the cheapest vegetables and pulses that you can manage, you are safe.

You should understand the costs of living are not the same anymore. You need a buffer fund for the future and the unexpected. With the above scenario you are left with Rs 3,000 monthly. If you have to spend it on one or two pizza outings, you will be completely ruined. If your niece or nephew’s birthday or any other friends birthday is around the corner, looking for a gift will suddenly turn into a nightmare.

Be responsible the country (at least Mauritius) has a good network of public transport and this is a sacrifice you have to make avoid taking debts.

Note: We operate at different economies of scales. We earn in Mauritian Rupees. For a perspective, last year I was earning USD 375/month (USD 4,500/yearly) and I would still be earning this if I had not shifted jobs (not a big shift, but better with a 25% increase!) So, you will understand why this rigourous financial planning was required.

Comments & Discussion

13 COMMENTS

Please login to read members' comments and participate in the discussion.