Pranam Swamiji. This is Sanghamitra after a long gap!

With the baby on my lap, I got some time to go through some articles which I had written early in my Banking career for the general public. I want to share them as a series.

There are certain banking terminologies that have critical applications in Monetary Policies. We might have studied them from exam point of view. But apart from the book definitions what else we know about them? What is the fundamental principle underlying them? While going through an article I got inspired to write something which even ordinary public can understand without much fuss. So let the journey begin…

Liquidity: Liquidity is a relative term. To explain this, let’s take the following examples

Liquidity for assets: Rs.1 crore worth gold is more liquid than the Juhu Beach flat worth Rs.1 crore (especially in the time of recession!). This is because one can quickly sell the gold in a few days, but for selling the flat one has to deal with so many prospective customers, real-estate agents, paper work, stamp duty etc. This would definitely take more days than selling gold.

Hence, in one line it can be summed up that the faster you can convert an asset into (liquid) cash the higher is the liquidity of the asset.

Liquidity for banking: if yesterday XYZ bank had Rs.100 to give as loan & today it has Rs.200 to give as loan, then we say liquidity has increased. The vice versa is also true.

Hence, in one line it can be summed up that the more a bank can offer as loan, the more is its liquidity.

A real life example of liquidity can be cited as follows.

In winter, supply of green vegetables increases (compared to summer) so selling price of green vegetables decreases in winter (compared to summer). Technically it is nothing but the liquidity of vegetables. Similarly in case of economy, when liquidity (money supply) increases, the cost of borrowing (=interest rates) goes down.

But a word of caution to be followed here: very high liquidity can create demand pull inflation. This is because as surplus money is going around, people will not hesitate to shell out more bucks (as they have earned easy bucks i.e. at lower interest rate) for the same quality goods or service which they were buying at fewer prices few days ago!

Also very less liquidity will make cost of borrowing extremely high for businessman as a result he cannot easily start or expand his business which adversely affects both production as well as employability. Hence, this condition is also bad for an economy.

So one of the major jobs of RBI is to control this “liquidity” in banking system for which it uses following tools to control this liquidity / money supply in the banking system.

- Cash reserve Ratio (CRR)

- Statutory Liquidity Ratio (SLR)

- Liquidity Adjustment Facilities (LAF) (Repo and reverse repo)

- Open market operations (OMO)

Let us discuss the first point i.e. CRR (Cash reserve Ratio)

For the sake of simplicity, let’s assume there are only four groups in India: 1) common men and 2) businessmen 3) Commercial banks (XYZ) 4) Central Bank (RBI.)

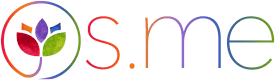

How do commercial banks make money? Common men save their money in bank. Bank gives them say 7% interest rate on savings. Then Bank gives that money as loan to businessmen and charges 12% interest rate. So 12-7=5% is the profit of Bank. Although that’s technically incorrect, because we’ve not counted bank’s input cost like staff salary, telephone-internet-electricity bill, office rent, xerox machine etc. Hence, actual profit will be less than 5%. But for easy understanding, first let’s carry on with this model.

a) XYZ has only one branch in a small town which was opened on Monday.

b) On the very same day, Total 100 common men deposited 1 lakh each in their savings accounts here (=total deposit is 1 crore) and XYZ offered them 7% interest rate per year on their savings.

c) On Tuesday, XYZ Branch manager gives away entire 1 crore to a businessman as loan for 12% interest rate for 5 years. From XYZ’s point of view, sounds very good right? 12-7=5% profit!

d) But we’ve not considered the fact that on Wednesday, some of those common men (account holders) will need to take out some money from their banks savings account- to pay for gas, electricity, mobile bills, college fees, writing cheques and demand drafts etc.

e) But XYZ’s office doesn’t have a single paisa left! => protest, rioting, suicides, opposition attacks Ruling Party, another Govt appointed probe committee…

So condition #1: Banks must not give away all of the deposit money to businessmen for loans. Banks must keep some money with aside. But who’ll decide how much minimum cash should a bank keep aside? RBI via CRR.

Jai Shri Hari.

To be continued…

Comments & Discussion

11 COMMENTS

Please login to read members' comments and participate in the discussion.