Sastang Pranam Swamiji at your lotus feet.

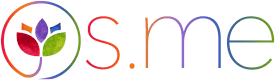

Let’s continue our journey of learning Economics and Banking Fundamentals.

Now let’s discuss about SLR (Statutory Liquidity Ratio)

Continuing the same example, XYZ got 1 crore on Monday. But suppose, RBI gave him order, “you must keep Rs.10 lakhs aside. (CRR)” Thus, XYZ is left with only 1 crore – 10 lakhs = 90 lakh rupees. So XYZ manager decides to get maximum profit out of remaining money. Suppose ongoing rate for business loans is 12%.

But there is one businessman Mr. Bagani. No bank is offering him loan, because of his past epic failure track record. This Mr. Bagani comes to XYZ and convinces the manager of granting loan with high interest rate of repayment & the loan was granted. But after six months, History repeats & Mr. Bagani’s new business project also collapsed.

He cannot pay back the EMIs. Although XYZ can attach his assets and auction them to recover the money, it’ll take lot of time. In the mean time, common-men also read this story in local newspapers and they panic that XYZ will collapse and bank manager will shut down the office and run away. So all the common men line up in front of bank and demand back their money. Recall that XYZ still has 10 lakh left in CRR. But people want total 1 crore back! Again money of account holders (aam aadmi) is stuck.

So, Condition #2: Bank must not give away all its loans to risky loan takers. Banks must invest part of its money in “safe and liquid” investment. So during emergency, bank can sell those “liquid” investments and take out the money. For example, Government securities, gold, corporate bonds of reputed companies like Infosys, reliance, TCS. These are “safe” investments. These are also “liquid”, because you can sell them quickly whenever you want. XYZ could also auction Mr.Bagani’s properties, but it’ll take lot of time in paperwork, legal issues etc.

So, bank should invest part of common-men’s money in “safe” investments like Government securities, gold and corporate bonds of highly reputed companies. BUT who will decide how much money should be invested in this sector? RBI via SLR (Statutory liquidity ratio)

Why CRR & SLR are the lifeline of banks?

Suppose a rival bank of XYZ, hires some people to spread rumours against XYZ that it is bankrupt. Say, out of the 100 XYZ account holders (common men), 30 common men believe in this rumour and run to the XYZ office to demand their entire savings deposit. Such panic movement of bank customers is known as “bank run”. As XYZ has total 10 lakh (CRR), it can directly give it back. XYZ also has set aside Rs.25 lakhs under (SLR), so XYZ can sell away those Government securities, gold worth 25 lakhs and give that money back to account holders.

Thus, CRR & SLR protect a bank against Bank runs.

Now let’s see some other terms.

Priority Sector Lending

Now XYZ manager starts making calculation, how much money is left with him?

Deposit = 100 L, CRR=10L, SLR=25L, Balance money= 100-10-25=65 L. Out of that 65L, let’s assume XYZ manager has to keep aside 15L for Administrative costs, salaries of employees, electricity bill, internet bill, Xerox machine etc. So he has 50L left for providing “loan” to needy people. Now loan-takers line up in front of XYZ office.

50 farmers: Give us loans of 1 lakhs each for buying seeds and fertilizers. However, given the vagaries of monsoon and low profit margin in agriculture, we cannot pay more than 5% interest rate.

25 Small businessmen: Give us loans of 2 lakhs each to setup small retail shops / car mechanic / hair saloon etc. We offer 11% interest rate. we cannot offer a penny more because our profit margin is not good.

2 Students: Sir please give us loan of Rs.25 lakhs each, for paying self-financed medical college. We can pay at most 9% interest rate.

1 Big businessman: Give me those 50 lakhs. In a few months, Diwali is coming and I want to setup a new firecracker factory. I offer you 15% interest rate.

If bank runs from purely profit point of view, then farmers, small businessmen, students and weaker sections of the society will never get any loan as they are paying less interest. Then who is going to protect those weak people? Who is going to help them get loans at reasonable rates? Again RBI, through Priority Sector Lending like agriculture, small scale business, housing and education.

That’s all for this class.

To be continued…

Comments & Discussion

4 COMMENTS

Please login to read members' comments and participate in the discussion.