Sastang Pranam at your lotus feet Swamiji.

In the previous article we have seen what are CRR and SLR & their importance and Priority Sector Lending. Now let’s see some other terms.

Net Demand and Time Liabilities (NDTL)

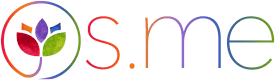

Till now we know that Banks have to comply with the CRR, SLR and priority sector lending rules of RBI. CRR, SLR is determined on amount of money a bank receives. But bank receives lot of money in various ways. So how does bank exactly calculate CRR, SLR requirements? = Net Demand and Time Liabilities (NDTL)

Time Liabilities (Transactions involving time-tag) example: Money deposited in fixed deposits (FD), Cash certificates, gold deposits. Demand liabilities (Transactions to be carried out on demand irrespective of time) example: Money deposited in savings account, Money deposited in current account, Demand drafts.

All banks have to send reports to RBI on fortnight basis that “Our NDTL is xyz and we are maintaining abc SLR and CRR on it as per your direction.”

Reverse REPO Rate:

Remember our Mr. Bagani! After several EPIC FAILs finally he started earning some nice bucks from his business. He invested money in BPO sector & due to weakening rupee value (1$>Rs.60) makes lots of moolah as he gets paid in dollar. But his fellow Indian Businessmen are scared to take further loans from banks as they are afraid of weak market conditions (import has become costly). So now everybody is convinced that Mr. Bagani is an ultapulta guy! He prospers when others suffer & vice versa.

Anyway, now bank has Mr. Bagani’s loan repayment money & no takers for the offered loans. This money is just gathering dust in the office. What to do, because bank has to give 7% interest even on this money also as it belongs to the depositors. So it cannot afford to let this money gather dust!

Now comes the Liquidity adjustment facility, Reverse REPO Rate. The book definition of Reverse repo rate is “it is interest rate paid by RBI to its clients for short term loans.” Reverse repo rate in crude words is when banks park their surplus money in RBI for short term, the rate at which they make profit. But in reality it works in a bit complicated manner i.e. via selling and repurchase of Government securities.

Basically Govt Security is a piece of paper. It has agreement something like: “whoever gives me Rs.100 will get 8% interest rate for 10 years and then principle will be repaid”.

Let’s say RBI has Government securities worth Rs.100L. XYZ has surplus Rs.100L and nobody is taking them as loans. But XYZ is sure more people will come to take loans before Diwali. So XYZ just wants to park this surplus 100 L somewhere for the short-term. XYZ enters into Reverse Repo agreement with RBI as “I (XYZ) will give buy Government securities worth Rs.100L from the RBI and RBI promises to buy back those securities from me after 6 months @Rs.106L.”

REPO Rate:

Repo rate is the rate RBI charges on its clients for short term loans. i.e. opposite of Reverse REPO Rate. Now the above example gets reversed. As again market improves & economy prospers (in general & not only from Mr. Bagani’s point of view!) more people line up for loan.

Let’s say RBI has cash of Rs.100L. XYZ has Government securities worth Rs.100L. XYZ enters into Repo agreement with RBI as “I (XYZ) am selling my Government securities worth Rs.100L to RBI and I (XYZ) promise to buy back(repurchase) those securities from RBI after 6 months @Rs.107L.”

Tied Rates Policy:

In 2011, under RBI made following rule:

- reverse repo rate would not be announced separately but will be linked to repo rate.

- The reverse repo rate will be 100 basis points below repo rate. (=minus 1%)

So if RBI declares “Repo rate=8%” then reverse repo-rate is automatically 8-1=7%.

Thanking you for your patience. That’s all for this session. Jai Shri Hari…

Comments & Discussion

8 COMMENTS

Please login to read members' comments and participate in the discussion.