There are three equations that have helped me during my professional career. They are quite simple and provided very good perspectives to me at various stages. All of them came to be known to me from various sources.

Motivation for my own learning and reason for sharing them here lies in an answer by actor Shahrukh Khan in an interview very early in his career. He was asked – “What is your formal education?” I loved his response (paraphrased) – “I have studied whatever that is required for me to understand each and everything published in a Newspaper.”

Finance 101:

This was told me by a senior professional in my first assignment. We all meet some mentors who are working in an organization for quite a while. We form an excellent rapport with some of them and the gentleman who told to me this equation was such a person. I was lucky to know him as he helped me on many fronts. Here is the equation he told me:

Income – Expenses = Savings

Simple, yet triggers thinking and helps in strategizing. Well, my mentor described this in relation to stages in career. As we start our career and assuming single status, our expenses are rather limited and one can accrue reasonable savings. As such, the goal is also to build savings recognizing that future expenses are going to mount. At this stage, goal is to minimize expenses to achieve the goal of savings.

As one moves on and begins a family, the equation changes to:

Income – Savings = Expenses

At this stage, unless Income increases proportional to Expenses, savings get depleted. The focus, therefore, is to increase Income. My mentor elaborated further including inflation and how salary structure, such as, Dearness Allowance comes into play, the reasons for subscribing to Insurance early in career and so on.

We could drill further with this equation; will do so with just one approach. Expenses can be further analyzed as two components – Fixed Expenses and Variable Expenses. For example, food, rent, basic hygiene and clothes are required and form the Fixed Part. Entertainment, travel, utility bills, etc. could form the Variable component (essentially Discretionary expenses which, by the way is another name for Variable component.) One can plan to invest a part of the savings early in the career so that that there are fixed inflows to offset the fixed expenses (comes handy in times we are going through.) One can explore other strategic options to realize the financial goals as also include further factors into the equation.

Business 101:

Learnt this equation from a Brochure of a High-End Engineering software in my second assignment (cannot recall the name):

P = (MS)³

Profit = Market Size x Market Share x Margin on Sales

This is incredibly simple to remember; however, very useful when one dives into it. The deeper the dive, more the revelations.

Market Size refers to a segment. For example, for soft drinks segment, Market Size is the total sales of soft drinks globally. Pepsi is one company serving this segment and Market Share refers to the sales of Pepsi globally. Of course, there are other companies playing in the segment and the sum total of share of all companies will add up to the Market Size. Margin on Sales is difference between the selling price and cost of product. The equation captures the Big Picture. There are numerous ways this can be used.

For example, Research and Development can impact all three multipliers positively. With a product for an unfulfilled need developed in-house through Research and Development, one is defining a new market and, therefore, Market Size. Market Share could be also 100% if the know-how is protected and difficult to copy. Profitability will be high because Margin on Sales could be high, if demand is high. It is complete monopoly and current example is YouTube. Many more examples can be discussed but will leave it for you to explore.

Alternately, Research and Development could be deployed to alter the engineering value chain to increase the Margin on Sales. This is where Innovation matters. One can map each and every function in a company to explore how and which multiplier they can influence? The equation can also be used to assess: “In role assigned to me, which multiplier am I contributing to and how can I increase the impact?”

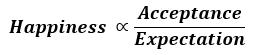

Happiness 101:

This is the one that came out while discussing with a colleague who was close to retirement.

(Read symbol ∝ as “Proportional to”)

Easier to write than to implement. It may take a life time to achieve 100% Acceptance and 0% Expectations. As they say, we need to work towards it so that our Happiness rises, even if it is incremental. Of course, unlike the first two equations this one is not measurable and, therefore, more challenging. Needless to say, many posts on this platform have given us ways to enhance the happiness index.

The beauty about the three equations is they capture the Big Picture elegantly. Personally, I maintain an Excel sheet for my finances, understand the strategies of companies based on the multipliers of profit and keep a log to analyze how am I doing on acceptance and expectations front. I hope you find them of utility in your life.

Stay Safe, Stay Protected and Stay Blessed, always.

Comments & Discussion

13 COMMENTS

Please login to read members' comments and participate in the discussion.